Trends in American Addiction Treatment: State Data

In recent years, America’s addiction treatment industry has been transformed by twin forces: the opioid epidemic and the Affordable Care Act. Overdose deaths have climbed steadily since the early 2000s, creating a crisis of unprecedented proportions. Simultaneously, the ACA extended health coverage to millions of previously uninsured Americans and mandated the coverage of substance abuse treatment. This combination of widespread need and broadened coverage has dramatically expanded demand for treatment – and permanently altered the recovery industry in the process.

In this project, we set out to study emerging trends in America’s treatment industry. By analyzing data from SAMHSA’s National Survey of Substance Abuse Treatment Services from 2000 through 2016, we’ve uncovered compelling shifts in the composition of treatment facilities across the country. From the rise of for-profit providers to the uneven adoption of medication-based approaches, our findings reveal an ongoing evolution in substance abuse treatment. To learn about the vast and varied world of U.S. rehabilitation centers, keep reading.

For-Profit, For Free?

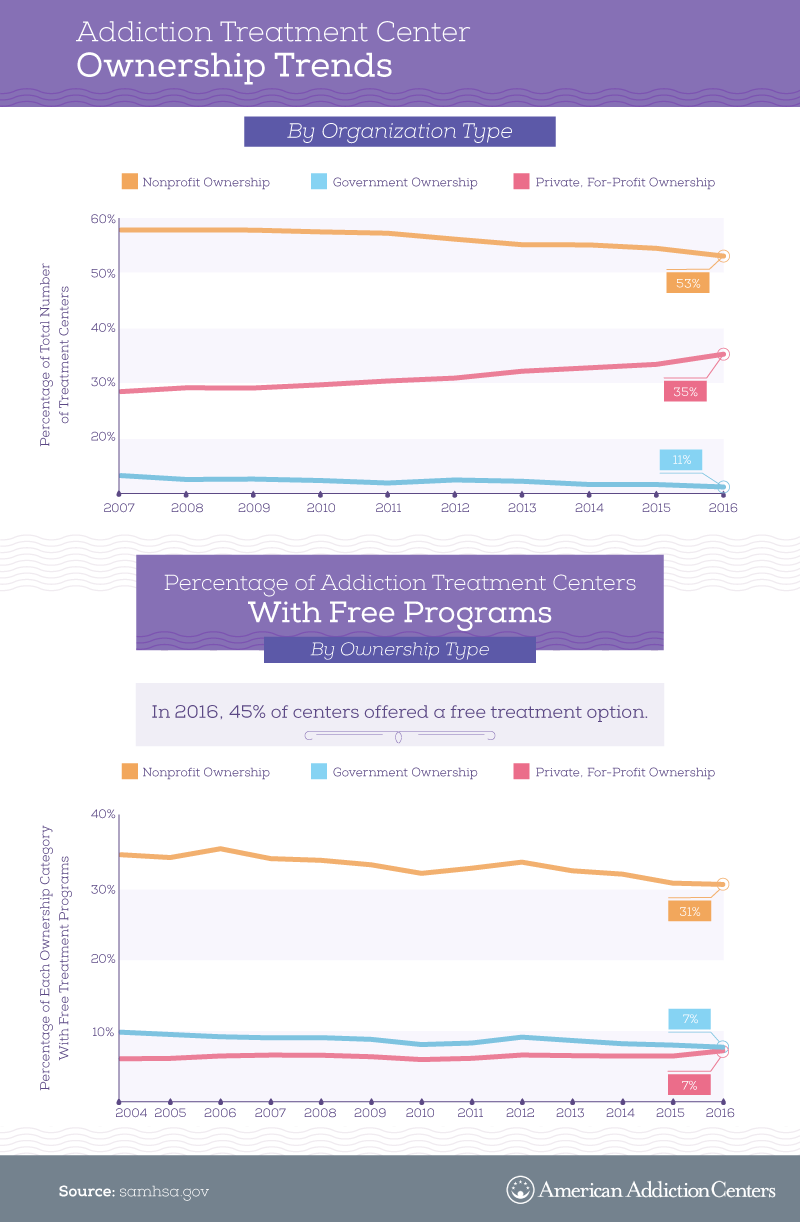

In recent years, addiction treatment has emerged as a growing industry for organizations in search of profit. Whereas the percentage of treatment centers operated by government or nonprofit treatment centers declined steadily between 2004 and 2016, for-profit entities increased by 21 percent. This shift toward privatized care likely reflects expanded demand for treatment services: Once the Affordable Care Act made substance abuse treatment an essential health benefit for millions, for-profit providers seized the opportunity to serve this new market.

In fact, the percentage of private, for-profit entities even increased among facilities offering treatment at no cost to patients. This finding might seem counterintuitive in some respects: Private treatment facilities are often associated with high costs relative to government or nonprofit alternatives. But for-profit facilities frequently receive revenue from government funding sources, instead of or in addition to payments from patients or insurance companies. In 2016, the latest year of our data, roughly 15 percent of for-profit treatment centers received some form of government funding.

Free Treatment Facilities, by State

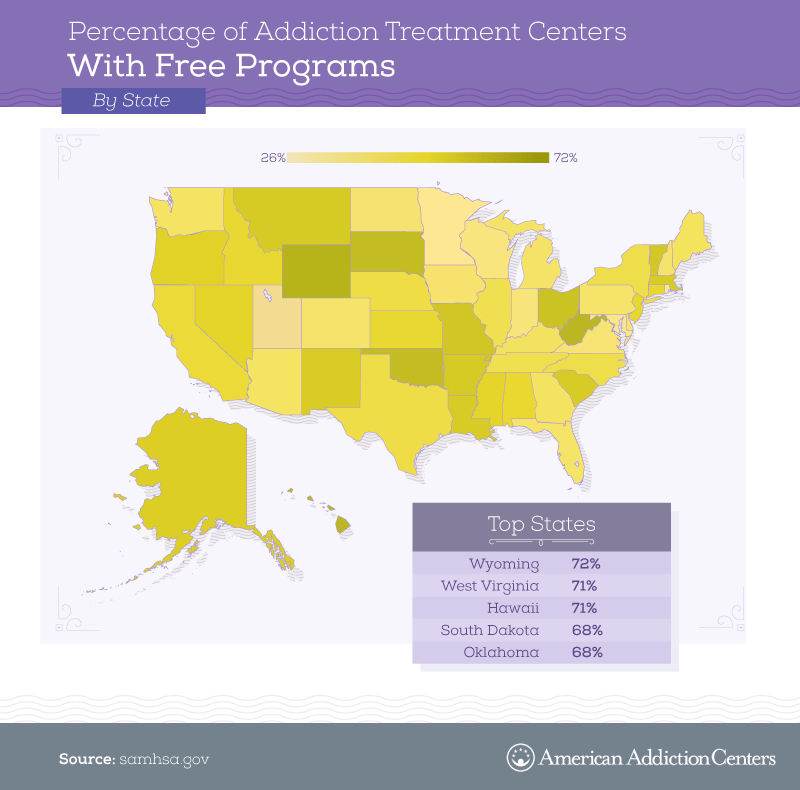

In most states, free treatment programs represent just a fraction of all rehab facilities. As such, many free facilities maintain stringent eligibility requirements to manage demand for their services. Wyoming was the notable exception to this rule: Of all the state’s treatment centers, 72 percent offered a free service. Indeed, these figures indicate that access to treatment at no cost may be saving lives in the Equality State. According to recent federal data, the rate of opioid-related overdose deaths in Wyoming is far less than the national average.

Elsewhere, however, states with a relatively high percentage of free programs still faced grim overdose statistics. West Virginia, which tied for second in percentage of no-cost facilities, has made significant investments in public treatment and harm reduction programs to curb its nation-leading overdose rate.

Center Ownership Across the Country

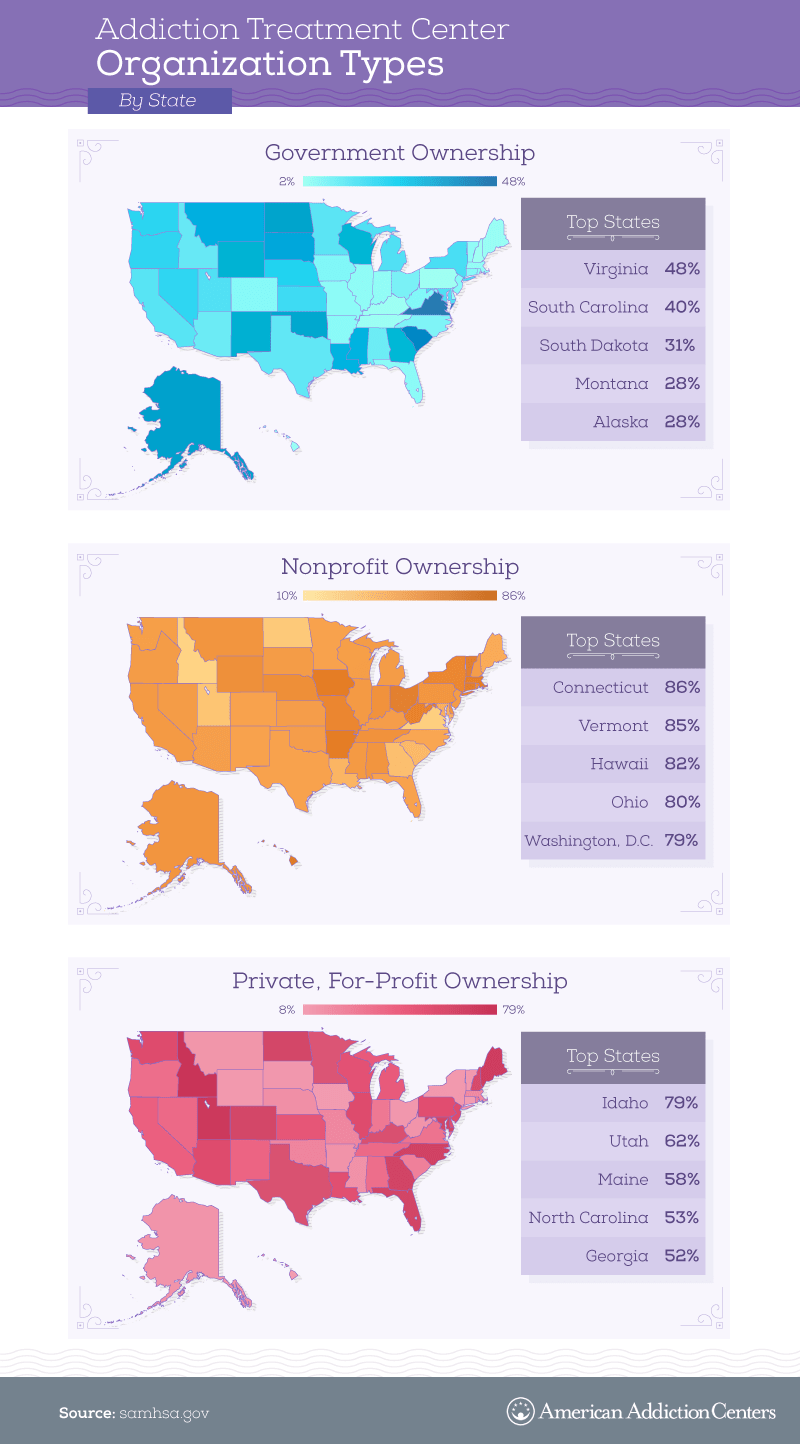

Treatment center ownership differed substantially by state. In Virginia, for example, nearly half of all facilities were government-owned (the state has recently sought to incentivize the creation of new programs by loosening Medicaid regulations). The more common pattern, however, was for the majority of treatment facilities in a given state to be nonprofit entities. This was particularly true in the Northeast and Midwest, regions hard hit by the opioid epidemic.

Elsewhere, government or nonprofit programs were few and far between. In Idaho, where budgeting issues have plagued state-run treatment programs, roughly 4 in 5 facilities were private, for-profit entities. Utah was similarly reliant on for-profit facilities, although the state has emphasized alternative measures to curb its drug challenges, including education and harm reduction programs. In Maine, access to treatment has become a point of intense political debate, with critics insisting the state must do more to offer low-cost programs.

Industry Growth Geography

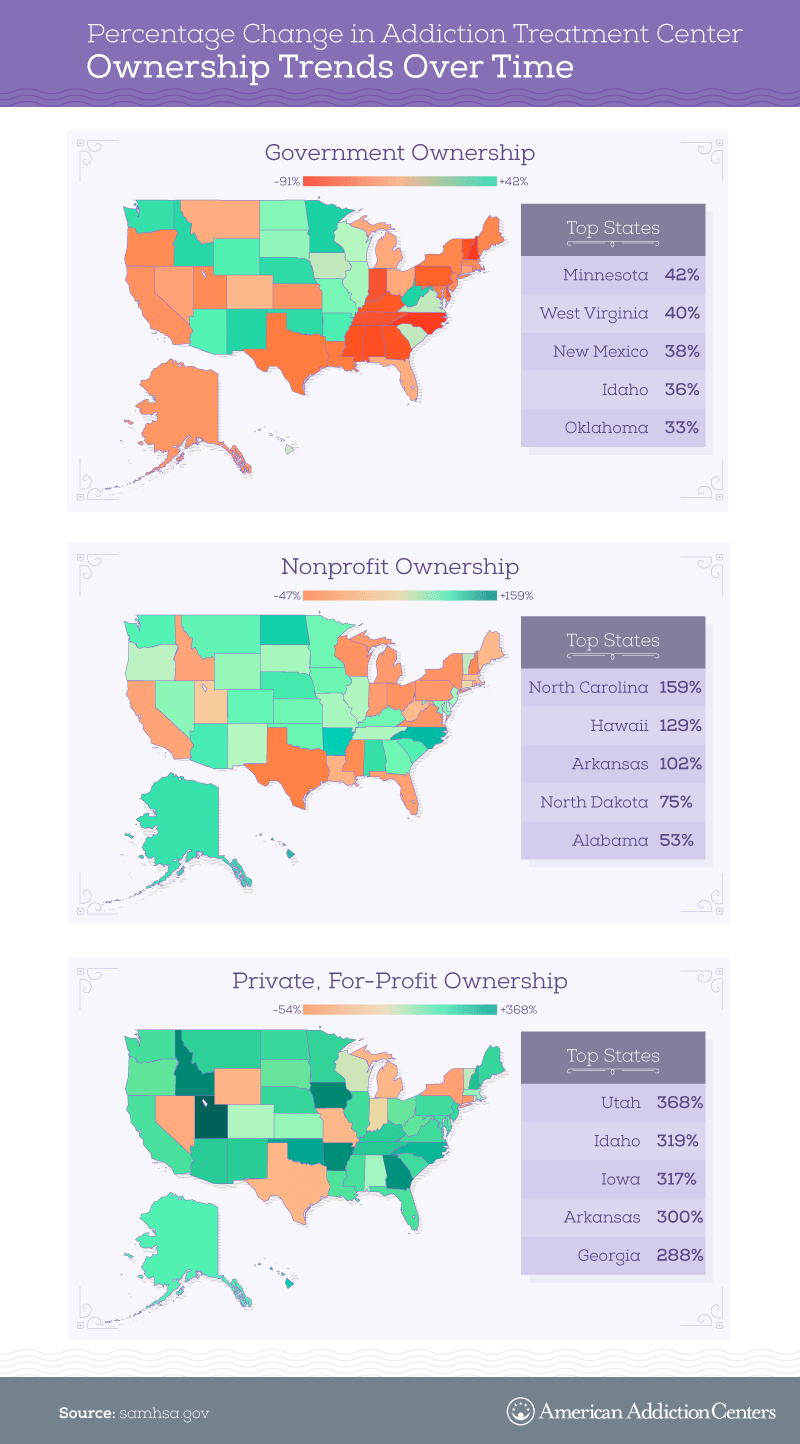

If recent years have brought significant change to America’s treatment industry, where are shifts in facility ownership most dramatic? In states like Minnesota, government-owned treatment facilities have grown at an impressive clip, expanding 42 percent between 2000 and 2016. West Virginia’s government facilities grew by 40 percent during that time, and the state plans to spend money won in legal settlements with opioid distributors to expand government treatment services further. Other states have witnessed more growth in the nonprofit sector, with North Carolina, Hawaii, and Arkansas each seeing nonprofit facilities increase over 100 percent from 2000 to 2016.

Still, the most explosive examples of growth emerged in the private, for-profit treatment space. In Utah, Idaho, Iowa, and Arkansas, for-profit treatment providers grew at least 300 percent during the period studied. Interestingly, states typically associated with robust (and potentially problematic) treatment industries, such as Florida or California, demonstrated comparatively modest growth. A handful of states, including New York and Texas, even saw the presence of for-profit providers decline during the years analyzed.

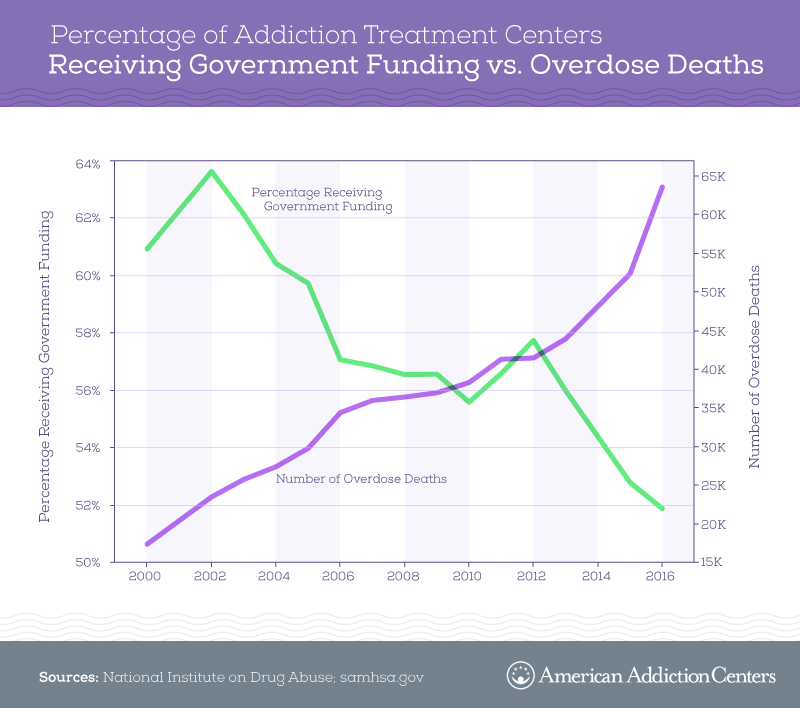

Funding and Fatalities

Our data suggest a profoundly troubling trend: As fatal overdoses have surged in recent years, the percentage of treatment centers receiving government funding has substantially declined. Between 2000 and 2005, at least 60 percent of treatment centers received some form of government funding. In 2016, merely 52 percent of facilities reported funding from a government source, the lowest rate during the period studied.

This trend may be partially attributable to the rise of for-profit entities and the concurrent decline of nonprofit and government-owned treatment centers. As we mentioned earlier, for-profit operations sometimes receive government funding. Still, scarcity of funding has consistently hindered efforts to combat the opioid epidemic at the state and federal levels and remains a pressing challenge. In places like Oklahoma and Colorado, cuts to treatment programs have been necessary even as overdose deaths continue to mount.

Medication and Maintenance

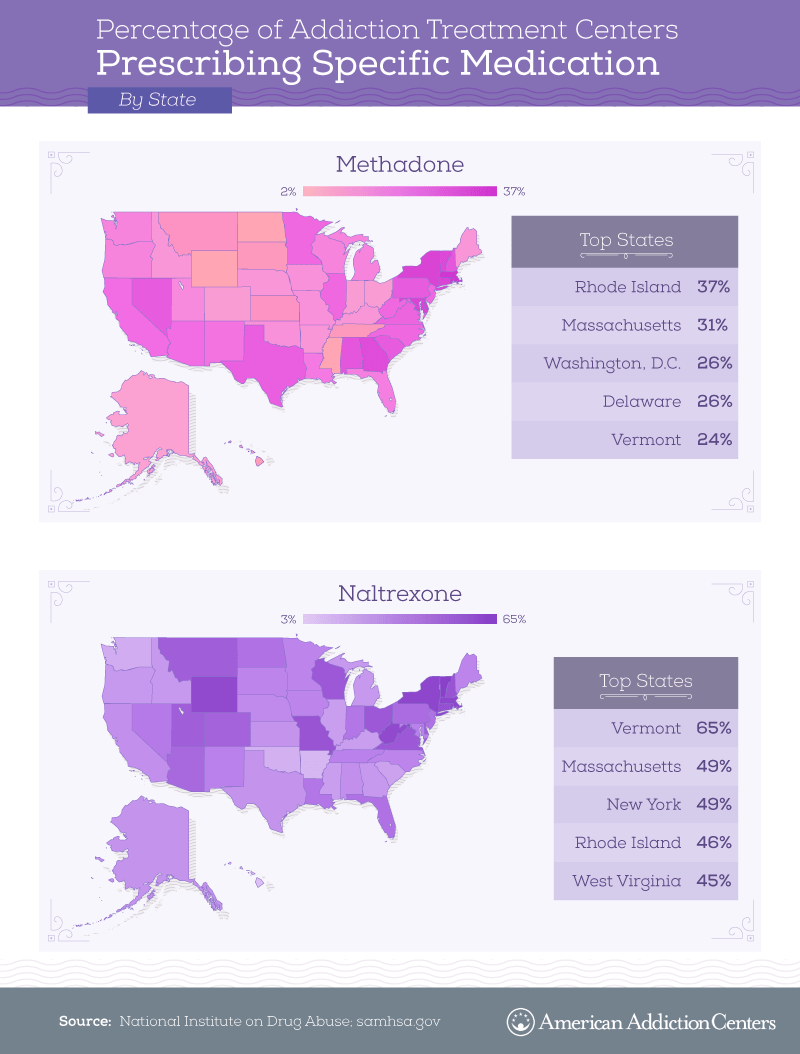

In recent years, experts have criticized the absence of medication-assisted approaches from substance abuse treatment, suggesting an emphasis on total abstinence is detracting from patient care. While a variety of medications can be used to treat addiction symptoms, we’ve analyzed treatment centers in each state using methadone and naltrexone specifically.

The Northeast seemed particularly favorable to these approaches: Rhode Island, Vermont, and Massachusetts ranked among the top five states for both methadone and naltrexone. Vermont has particularly attracted attention as a model for other states hoping to expand medication-assisted treatment. Conversely, some Southern states had strikingly low rates of adoption for both medications. In Oklahoma and Arkansas, for example, less than 8 percent of treatment centers offered methadone, and less than 10 percent employed naltrexone.

The Advantage of Tailored Care

Our findings reveal substantial growth in some sectors of the substance abuse treatment industry, particularly in locations where government or private investment has surged in recent years. As our nation’s struggles with opioids rage on, treatment resources remain frustratingly scarce in many regions. Moreover, real and perceived financial barriers prevent many from obtaining the help they so desperately need. The increased availability of care is certainly encouraging, but quantity and quality of America’s treatment facilities remain insufficient in many respects.

For individuals with substance use issues and their families, this set of circumstances makes expert guidance imperative. Although many facilities make bold promises, it can be difficult to identify and obtain the best possible treatment options for your particular needs. Let our team of experts help you evaluate effective treatment possibilities you can afford. Explore our information and consultation options today to learn how you can make recovery a reality.

Methodology

Using the National Survey of Substance Abuse Treatment Services (N-SSATS) published by the Substance Abuse and Mental Health Services Administration (SAMHSA), we analyzed trends from 2000 to 2016.

According to N-SSATS, three data collection methods were used including a secure web-based questionnaire, a paper questionnaire sent by mail, and a telephone interview. N-SSATS performed quality assurance procedures to ensure accuracy. For more information on the data collection procedures, please visit samhsa.gov/data.

Sources

- https://www.drugabuse.gov/related-topics/trends-statistics/overdose-death-rates

- https://wwwdasis.samhsa.gov/dasis2/nssats.htm

- https://www.healthcare.gov/coverage/mental-health-substance-abuse-coverage/

- https://wwwdasis.samhsa.gov/dasis2/nssats/2016_nssats_rpt.pdf

- https://www.drugabuse.gov/drugs-abuse/opioids/opioid-summaries-by-state/hawaii-opioid-summary

- https://www.cbsnews.com/news/west-virginia-distributing-8000-opioid-antidote-kits-in-effort-to-stem-overdoses/

- https://www.pbs.org/newshour/show/new-mexico-deploys-best-practices-avoid-worst-outcomes-opioid-crisis

- https://www.pbs.org/newshour/health/virginia-dramatically-expanded-treatment-options-addiction-skirted-federal-law

- https://www.cdc.gov/drugoverdose/data/statedeaths.html

- https://www.idahostatesman.com/news/politics-government/state-politics/article195103734.html

- https://www.pressherald.com/2017/03/14/lepage-defends-handling-of-drug-crisis-says-access-to-treatment-isnt-an-issue/

- https://www.insurancejournal.com/news/southeast/2017/04/13/447733.htm

- https://www.nbcnews.com/feature/megyn-kelly/florida-s-billion-dollar-drug-treatment-industry-plagued-overdoses-fraud-n773376

- https://www.ocregister.com/2017/05/21/how-some-southern-california-drug-rehab-centers-exploit-addiction/

- https://www.vox.com/policy-and-politics/2018/3/22/17150294/congress-omnibus-bill-opioid-epidemic

- https://www.npr.org/sections/health-shots/2018/03/01/589572710/states-seek-more-federal-funding-for-opioid-treatment-not-more-promises

- https://www.vox.com/science-and-health/2017/7/20/15937896/medication-assisted-treatment-methadone-buprenorphine-naltrexone

- https://www.vox.com/policy-and-politics/2017/10/30/16339672/opioid-epidemic-vermont-hub-spoke

Fair Use Statement

If you’d like to share our findings of the ongoing growth of the addiction treatment industry, feel free to use our images and information on your site or social media for noncommercial purposes. Simply link back to this page to attribute us appropriately.