Insurance Coverage for Rehab: Does Insurance Cover Rehab?

Does Your Health Insurance Cover Substance Use Treatment?

Yes, health insurance plans will generally cover the cost of treatment for substance use disorder (drug and alcohol addiction) and mental health conditions. The particular health insurance plan that you have will determine how much of your treatment is covered by your insurance plan, as well as how much you will be required to pay out-of-pocket. It’s best to check with your insurance provider before trying to enter a treatment program for substance abuse issues to understand the details of what is covered under your plan.

Find out instantly if your insurance may be able to cover all or part of the cost of addiction treatment. Or call us today at You will speak with an admissions navigator, and they can help you through the verification process. American Addiction Centers can take the confusion out of contacting your insurance provider directly. Simply call us or fill in the form below and we can communicate with your insurance directly. By filling in our confidential form below, we can find out which treatment centers are in-network, we can advise you on the length of stay covered, and we can save you time and from the hassle of contacting your insurance company and/or looking through hard to understand insurance documents.

Insurance Providers and Rehab Coverage

Health insurance benefits are designed to make health care both affordable and accessible, and there’s no stigma attached to asking for help. People with addictions and insurance should use their coverage to the fullest in order to get the care they need to leave addictions behind for good. Talking to plan administrators is a great place to start, but remember that the staff of addiction treatment facilities can also be of vital help.

In some cases, they can smooth the path to payment, so families have one less thing to worry over as they recover. Explore more information about insurance providers and rehab coverage below. Call us at If you do not see your provider listed below, we may still be able to work with you or your insurance provider to find treatment.

Options With and Without Insurance

Common Types of Healthcare Plans and Benefits

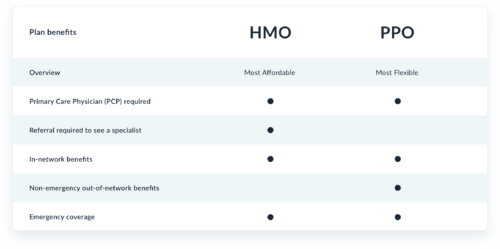

The three most common healthcare plans are health maintenance organization (HMO) plans, preferred provider organization (PPO) plans, and point of sale (POS) plans.4 Substance abuse treatment and recovery may be covered by your insurance provider. Learn more about which plan, HMO or PPO, offers the best coverage:

Cost and Coverage

Rehabs That May Accept This Insurance

Frequently Asked Questions

How to bill insurance for substance abuse treatment?

How to get financial assistance for substance abuse treatment?

What is the cost of outpatient substance abuse treatment?

Can I Get or Change My Health Insurance Coverage After a Qualifying Life Event?

- Losing existing job-based, individual, or student health coverage.

- Losing eligibility for Medicare, Medicaid, or Children’s Health Insurance Program (CHIP).

- Turning 26 years old and losing health coverage under your parent’s insurance plan. Getting married or divorced.

- Having a baby or adopting a child.

- A death in your family that affects your health coverage.

- Moving to a different zip code or county that changes your health plan area.

- Moving as a student to or from the place where you will go to school.

- Moving to or from the place where you live and work as a seasonal worker.

- Moving to or from a shelter or other transitional housing.

- Experiencing changes in your income that affect your qualifying coverage.

- Gaining membership in a federally recognized tribe or status as an Alaska Native Claims Settlement Act (ANCSA) Corporation shareholder.

- Becoming a U.S. citizen.

- Leaving incarceration such as jail or prison.

- Starting or ending service as an AmeriCorps member.

Can I Have Multiple Insurance Providers?

- You are married and covered under your insurance plan and your spouse’s.

- You are under 26 years old and covered by your parents’ insurance and your own.

- You are under 26 years old with divorced parents and are under both parents’ plan as a dependent. You are over 65 years old and have coverage through your employer and Medicare. If you have two separate health insurance plans, one plan will be your primary coverage and the other is your secondary coverage. Your primary provider pays first – up to its coverage limits. Your secondary insurance will then step in and pay the remaining cost (partial or full) of the treatment(s). Even after secondary insurance pays, you may still have some out-of-pocket costs.